Hundreds of parcels of land, land or buildings located in Quebec City territory could be put up for auction on November 22 if their owners do not pay their debts to the municipality on time.

After a period of no less than six months, the law allows municipalities to put up for sale any property on which taxes have not been paid, regardless of the amount owed.

At the end of September, 503 properties in Quebec were threatened with being put up for auction by the city. Excluding 2022, which includes amounts due in 2020 and 2021, this is the largest number of buildings whose owners have defaulted for five years.

Properties at auction for unpaid taxes in Quebec City

| year | Number of properties |

|---|---|

| 2018 | 339 |

| 2019 | 388 |

| 2021 | 142 |

| 2022* | 531 |

| 2023 | 503 |

According to Jean-Pascal Lavoie, a spokesman for Quebec City, this number is “comparable” to those of previous years. Delete access to the first place on your face, the number of battery boxes on your phone at 363. And this year, the most important properties do not have any money to pay for your purchases. in time. Since 2018, 88 properties have been sold during these auctions.

Over the coming weeks, the City will reach out to owners affected by this action to support them in finding a solution.

Mr. Lavoie mentions via email.

Since 2018, 88 properties have been sold at auction by Quebec City.

Photo: Radio-Canada/Alexander Vale-Roy

All things say, the number of buildings appearing on the list will decrease between now and the scheduled sale date of November 22.

“It’s just the beginning”

These numbers do not surprise Christian Pierre Coté, a specialist in research and data analysis at Côte-Mercier. It’s just the beginning

He said. Since March 2022, the Bank of Canada’s key interest rate has risen from 0.25% to 5%. But Mr. Côté points out that many owners with fixed-rate mortgage agreements have so far survived the increase, and the central bank has not ruled out raising interest rates.

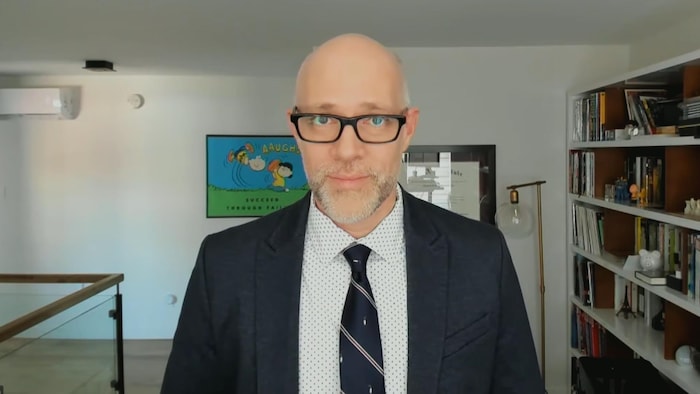

Stephane Leblond, bankruptcy and insolvency trustee, was also not surprised by the large number of owners in default.

Inflation and rising house prices Without any parity with the past

It hurts, he said. People delay paying taxes, there are a lot of people who delay their mortgage payments, and the banks accommodate them for a while, but at some point, something has to go wrong somewhere.

Stephane Leblond is a licensed insolvency trustee in Quebec.

Photo: Radio-Canada/Raphael Beaumont-Drouin

Interest rates are rising

Sebastian McMahon, chief strategist and chief economist at IA Industrielle Alliance, is saddened by these numbers, which he links to an increase in interest rates and the cost of living.

We see that this has side effects. There are families that are stuck a little bit, and then we see surpluses like this, so it’s very sad

He said.

Sebastian McMahon is Chief Strategist and Chief Economist at IA Industrielle Alliance. (archive photo)

Photo: Radio-Canada

In the short term, we should not expect a rapid return to low interest rates, but the situation could stabilize, he said.

When we look at central banks, the message is quite clear that we have reached the end of the tightening cycle.

Stephane Leblond believes that in some cases, heartbreaking choices must be made.

What is also difficult to understand is that their desire to preserve their home at all costs is, in some cases, possible, but in some cases, is the source of all their problems. 50, 60, 70% of their salaries go to their accommodation.

It calls on cities to reconsider the way they tax property owners based on increases in property values.

In collaboration with Jeremy Camerand

“Music guru. Incurable web practitioner. Thinker. Lifelong zombie junkie. Tv buff. Typical organizer. Evil beer scholar.”

More Stories

After the discovery of norovirus, these berries should not be eaten.

Mechanics Strike | WestJet Cancels Nearly 700 Flights, Affects Nearly 100,000 Passengers

Three 'basic' Airbnb listings: Owner shares how he easily skirted the rules